Health Care Fraud defense attorney, Andrew S. Feldman, published an article in the ABA Health Law’s monthly E-Source publication, A Cardiologist’s Recent Acquittal Should Send a Message With Respect to Future Medical Necessity Prosecutions. A link to the article is included here.

As reinforced throughout the article, the Government prosecuted a cardiologist for health care fraud related to a cardiologist’s decision to place heart stents in particular patients suffering from coronary heart disease. In such cases, a vigorous Health Care Fraud defense is critical. Indeed, the Government, in general, has increased the quantity and scope of medical necessity prosecutions. Simply put, a medical necessity prosecution is, simply put, a prosecution based on the theory that the service provided by the individual health care provider or physician (e.g. cardiologist, dermatologist, urologist, dentist, or spinal surgeon) was medically unnecessary. Whether or not a service or good is reasonable and necessary dictates whether the Government or a commercial payor will pay the physician’s tab. What the Government is saying is that you submitted your bill but we do not think we should pay because you are asking us to pay for services you say you performed but which we claim are unnecessary.

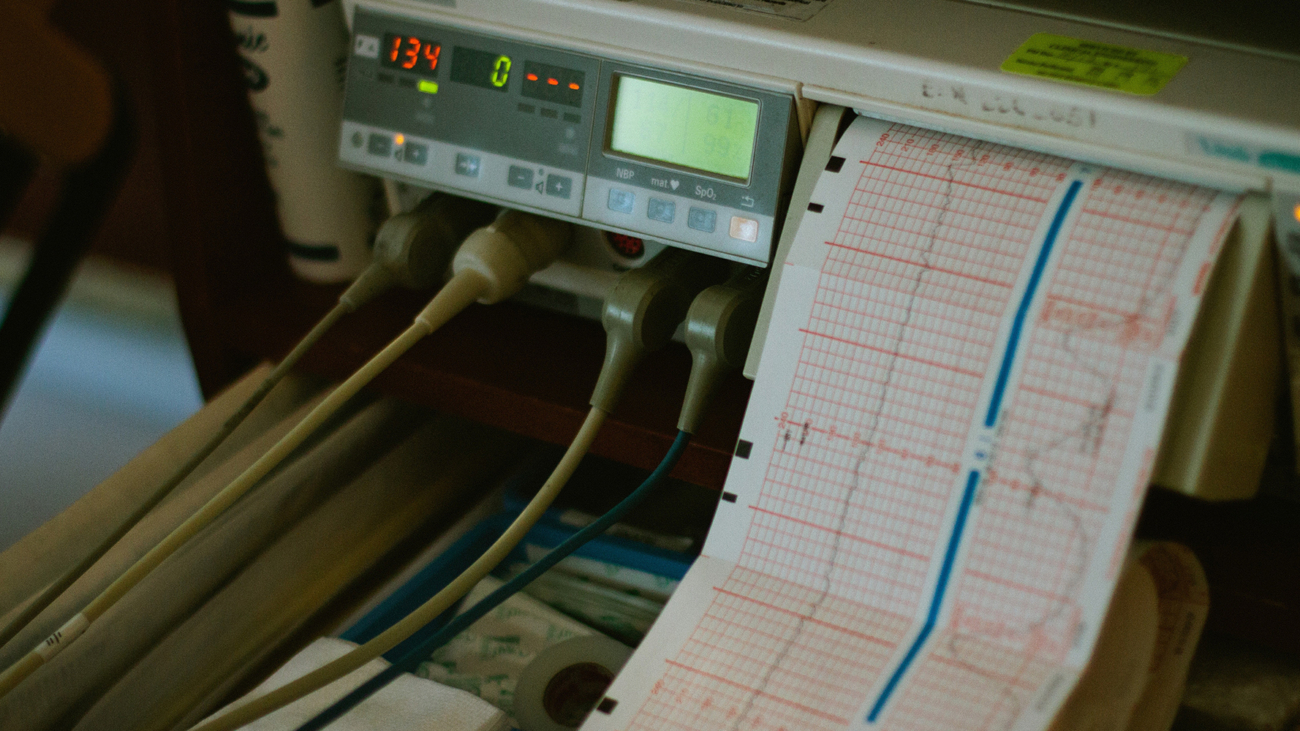

This is nothing new. What is new are prosecutions like the prosecution against Dr. Richard Paulus. A prosecution that, candidly, should have been declined at the investigative phase but instead prosecutors doubled down with a False Claims Act prosecution without a whistleblower on the exact same facts. The centerpiece of the Paulus indictment was that Dr. Paulus had performed cardiac stent procedures which were unnecessary to justify billing for these expensive cardiac procedures. In civil and criminal health care fraud land though, there must be a lie. What was the lie? According to the Government, it was the amount of blockage – the degree to which a heart valve is blocked and cannot circulate blood to the rest of the body – recorded by Dr. Paulus after his interpretation of patient angiograms. One problem (and there were a few) with that theory in Paulus’ case was that “expert” opinions on the degree and percentage of that blockage were all over the map – 20%, 40%, 70%, 80%. The Government experts also disagreed with one another on this critical issue. There was no clear financial motive, there was no evidence of destroying or concealing evidence, there was no evidence that Dr. Paulus recorded or directed others to record false patient symptoms to justify any of the cardiac stents. As the district court underscored in the Order entering a judgment of acquittal following trial – the health care fraud statute is “not intended to penalize a person who exercises a health care treatment choice or makes a medical or health care judgment in good faith simply because there is a difference of opinion regarding the form of diagnosis or treatment.”

Hiring a Health Care Fraud defense attorney is an important decision. The Feldman Firm would welcome the opportunity to assist you if you are under investigation for or if you have been accused of a health care fraud offense.